JavaScript is required for our website to function.

Please disable any browser extensions that block JavaScript from loading.

JavaScript is required for our website to function.

Please disable any browser extensions that block JavaScript from loading.

No download or credit card required

Did you know that the worldwide financial services industry was worth a whopping $25.99 trillion in 2022? Plus, the sector is projected to grow at a CAGR of 8.3 percent between 2022 and 2032.

Whether you’re building a fintech startup, scaling a small business, or running an asset management firm, these figures are encouraging. But with such an optimistic outlook comes stiff competition. As new players enter the market and industry leaders expand their offerings, how do you stay afloat?

Given the critical nature of transactions in the financial services industry, earning customer trust and loyalty to maximize customer retention can help you stand apart from competitors. A financial services CRM (customer relationship management) platform can help you stay a step ahead.

In this guide, we’ll take a closer look at financial services CRM software, outlining its importance and key features. We’ll also discuss a few tips to help you choose the right solution for your firm.

CRM for financial services refers to software that helps financial services firms manage contact information, business processes, client interactions and sales processes. You can use the platform for forecasting your sales pipeline and to qualify and nurture leads. You can also use it to personalize your communication with prospects and existing customers across various platforms.

Modern CRMs like Act! CRM come with user-friendly, built-in automation functionalities that help eliminate manual processes like data entry and scheduling follow-ups. Many of them also offer integrated data-driven insights and customizable dashboards and reporting as well as a suite of marketing features including email and SMS marketing capabilities. All these features come in handy for marketing, sales, and customer support teams and will optimize your customer satisfaction and customer engagement.

Whether you’re managing a financial advisory firm or investment bank, a CRM for financial services can be instrumental in strengthening client relationships for today’s wealth management and financial institutions. Ultimately, it will help you close more deals and positively impact your business’s bottom line.

The financial services industry is largely people-driven. For instance, financial advisors rely on client relationships built over the years to generate consistent revenue in addition to the influx of new clients. Similarly, financial planning companies earn substantial profits when they retain customers for several years.

On the other hand, the high-stakes nature of the industry makes it difficult to win and retain a customer’s trust. Case in point—76 percent of consumers will stop availing a company of its services (or purchasing their products) after a single negative customer experience. Further, 63 percent of consumers are willing to pay more for better customer service.

Given these figures, it isn’t surprising that 64 percent of financial services companies listed improving customer experience (CX) among their top five business priorities.

CRMs form the base of a solid customer experience. Without them, you’ll likely struggle to find your footing in the financial services industry. It’s becoming particularly crucial with changing consumer behavior and preferences, not to mention the need for personalization.

For instance, 67 percent of U.S. customers reported using their bank’s mobile app in 2021. That’s an increase of 7 percentage points from 2020. As consumers become more tech-savvy, they’ll conduct their research when looking for financial products.

They’ll visit your company’s website and LinkedIn page and may even follow you on Instagram before reaching out to your sales team. This gives you less control over their purchase journey and makes it difficult to retain them.

With financial CRM software, you can monitor and record customer interactions across different channels. It provides you with an accurate 360-degree view of prospects and customers to provide you with powerful lead management and helps you delight them with personalized communication.

Download this free guide to learn how CRM and Marketing Automation can help your financial services business provide stellar customer experiences and outpace the competition.

The global CRM software market is worth $71.06 billion and is projected to cross $157 billion by 2030. Before you start exploring the vast ocean of CRM solutions out there, it’s a good idea to consider what type of CRM platform fits your needs.

While there are different types of CRMs available in the market, they can be broadly categorized into the following:

Also known as self-hosted CRM, this type of CRM is installed and operated on your organization’s computers. It provides excellent control and security but requires ongoing maintenance. Also, you’ll need proper in-house infrastructure to get the software up and running.

A cloud-based CRM solution is hosted on the software provider’s servers. All you need is a stable internet connection to sign up for the software and start using it. The vendor takes care of software updates and maintenance, too.

Cloud-based CRM software is accessible from any device that’s connected to the internet. Team members can log in and monitor client interactions from any location. This makes it more cost-effective and flexible than on-premise CRMs.

As the name suggests, a hybrid CRM solution combines the best of both worlds. It retains the robust security of on-premise software while offering easy accessibility and flexibility of cloud-based ones.

Given the sheer size of the CRM software market, finding the right platform can be overwhelming. But keep in mind that not all CRM platforms are created equal. And even the most feature-packed ones may not cater to the financial services sector.

If you’re looking for CRM for financial advisors, investment bankers, insurers, or asset managers, keep an eye out for the following features.

Any standard financial services CRM platform will offer a central dashboard that ensures easy access to client data. That includes sales and customer service interactions, purchase history, email and SMS activity, and online behavior.

Act! CRM takes this a step forward with detailed customer profiles, making it easier and faster to find the information you need. You can collect and store data from a wide array of sources, be it phone calls, emails, or notes.

This saves sales reps and customer service executives the trouble of scrolling through endless spreadsheets, email threads, and phone records before addressing a client’s query. You can even filter the data by date, location, device, and more. That, in turn, improves the quality of client interactions and takes the customer experience up a notch.

The best CRM for financial services companies will let you visualize the sales pipeline. In other words, you can take a closer look at different stages of the sales funnel and monitor the status of individual leads. It can help you identify and eliminate points of friction in the customer journey.

Deeper insight into customer behavior can help sales reps focus on the right leads and even harness untapped sales opportunities. Additionally, with CRMs like Act!, you can filter sales pipeline data by location, sales stage, product, agent, and more to optimize sales processes.

A list of must-have CRM features won’t be complete without automation. Financial services CRMs don’t just let you automate routine tasks like data entry. Instead, they offer tools to automate entire sales workflows.

For instance, Act! allows you to build automated email drip campaigns to nurture qualified leads. When a lead opens an email and visits a product page on your website, the software can automatically schedule a follow-up call the next day. It can even assign the task to the right sales rep and send a reminder before the call.

Similarly, you can schedule automated follow-up emails or text messages after specific intervals. Such automation gives sales reps time to focus on more critical tasks, such as improving retention rates.

Financial services CRM software usually comes with built-in marketing features. For instance, Act! CRM lets you create email marketing campaigns to engage leads and drive conversions. You can even segment your email list and implement hyper-targeted campaigns to impress customers with personalized content and product recommendations.

Many CRMs even support integration with social media platforms, letting you monitor customer activity and personalize marketing campaigns.

You also get pre-designed landing page templates that come in handy for lead generation. You can customize these templates to fit your branding and publish them right away. The best part? When a prospect submits their contact details, the information is automatically added to the CRM.

Here’s the thing—collecting client data isn’t enough. Marketing, sales, and customer support teams must be able to use that data to derive actionable insights. The best financial services CRMs let you do that with robust built-in analytics dashboards.

You can track marketing and sales performance metrics in real time to understand whether your strategies are working as desired. This allows you to implement the necessary corrective actions at the right time. These insights also come in handy for evaluating your company’s overall financial health and generating revenue projections.

With a robust CRM like Act! CRM, you can even convert these insights into easy-to-understand reports.

Running a financial services firm in 2023 means you’re likely using different software solutions to manage business operations. Look for CRM tools that are compatible with other software in your tech stack.

For instance, finance CRM integrates with a wide array of software, from email, calendar, and productivity tools to e-commerce platforms and accounting software. Such integrations enable seamless transfer of data between the platforms and eliminate the need to keep switching between them.

Start your 14 day free trial today. No download or credit card required.

There’s no one-size-fits-all winner for the title of best CRM for financial services companies. It’s up to you to find one that suits your needs. Here are a few tips to help you get started.

Before you start shopping around for CRM software, it’s a good idea to know what you’re looking for. Consider the following questions:

Answering these questions will help you identify the key features you should look for in a CRM. It’ll also help you choose between on-premise and cloud-based CRM. Once you have a clear idea of these, set a realistic budget.

For instance, if you opt for cloud-based CRM software, keep in mind that you’ll likely have to upgrade to a more expensive plan as your customer base grows. On the other hand, for on-premise CRM, you’ll have to factor in infrastructure, scaling, and maintenance costs.

If the financial services CRM software you choose doesn’t integrate with the tools you’re currently using, it will result in several operational bottlenecks. That makes it crucial to take a closer look at your existing tech stack and find compatible CRM tools. Alternatively, you could consider CRMs like Act!, which supports integrations with a wide array of customer service, productivity, and sales tools.

It’s now time to explore different CRM tools that fit the bill. You’ll easily find different cloud-based CRM solutions on the internet. Sign up for a free trial or request a demo for a detailed walkthrough of how a tool works. If you’re looking for on-premise CRM software, ask the vendor for a demo before making the final selection.

Regardless of the type of CRM you choose, pay attention to the following when comparing different CRM platforms:

Depending on your business needs, it might make sense to look for a CRM that comes with a mobile app. For instance, Act! provides a mobile app for Android and iOS devices, which provides sales reps with instant access to client history and other details, regardless of their location. They can even get driving directions and locate customers in their area with heat maps.

Long-standing client relationships are the lifeblood of every financial services company. As consumers become more self-reliant in today’s fast-evolving landscape, traditional ways of engaging with them no longer work. That makes it crucial to find the right CRM software.

The best CRM software for financial services firms lets you streamline sales processes and implement personalized marketing campaigns. It also helps automate routine processes, enabling team members to work smarter. Ultimately, this results in a frictionless customer experience that ensures high conversion and retention rates.

Act! offers all the standard features you’d expect from a financial services CRM platform, including visual dashboards, in-depth analytics, and marketing automation. Sign up for a free trial to see it in action.

CRM for financial services is a type of software that helps companies manage client interactions and relationships. It provides a central dashboard to collect and store client data. The best CRM platforms come with additional features, such as personalized marketing, workflow automation, and analytics.

Each bank uses a CRM system from different software providers based on its requirements. If you’re looking for a customizable financial services CRM solution to manage your client information with built-in automation and analytics functionalities, Act! CRM is worth considering.

CRM stands for customer relationship management. It encompasses a wide array of tech and strategies used for contact management and to retain customers for the long haul. Financial services firms often benefit from using a CRM platform to monitor and manage client interactions.

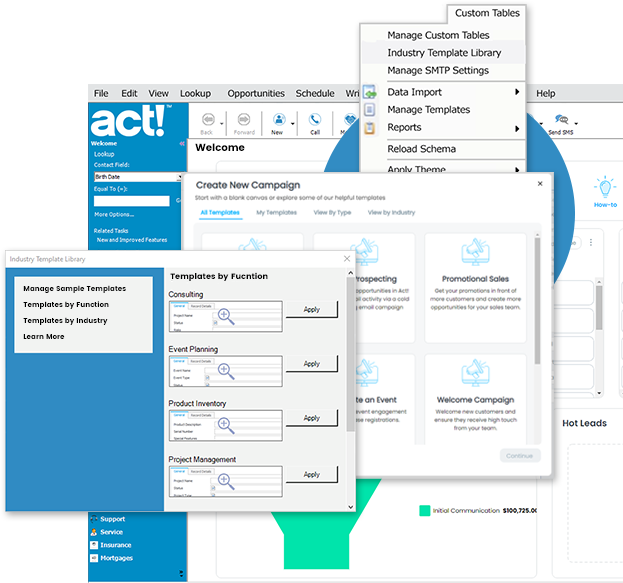

Tailor Act! to meet the unique need of your business. Get Started with 11 pre-built esay-to-use industry templates.

“From my early days as a brokerage consultant to now, Act! has always helped simplify finding, connecting, and

building relationships with clients. As Act!’s features continue to evolve, so do I-learning new ways to leverage

the software to provide better service to my clients.”

Matt Agnese

President, Plan B and C, inc.

Start your 14 day free trial today. No download or credit card required.