JavaScript is required for our website to function.

Please disable any browser extensions that block JavaScript from loading.

JavaScript is required for our website to function.

Please disable any browser extensions that block JavaScript from loading.

Businesses routinely track revenue and profits, but it’s also important to measure your company’s ability to retain existing customers. Going beyond profits and losses, your customer retention rate helps you see how well you keep customers over months or years. It gives you a measure of how well you prevent customer turnover, also known as churn. Without this information, you may not know that you have a problem until it’s too late.

While customer growth usually gets the lion’s share of the focus, retention is a key business driver. This is especially true for software-as-a-service or SaaS companies that operate on a recurring revenue model.

What is the retention rate and how do you calculate it? Here’s what business owners need to know about customer retention, how to work out customer retention rates, and other best practices.

Customer retention rate (CRR) is a figure that reveals how effective your organisation is at keeping customers happy so they continue doing business with your company. It’s expressed as the percentage of customers that stay with your company through such actions as repeat purchases, additional purchases, upgrades, or subscription renewals. You can take this measurement for any given period of time and should do it on a routine basis to ensure the continual growth of your company’s customer base.

A company’s customer (or client) retention rate is an indicator of how often they deliver positive customer experiences,—but it’s more than that. Top companies encourage repeat business and customer success through customer retention strategies and initiatives such as customer loyalty programs, subscriptions, or seasonal deals.

Customer retention is crucial for small businesses because the cost of acquiring a customer is much higher than the cost of retaining one.

An old rule of thumb used to be that it cost a business five times more to get a new customer than retain a current customer. However, this estimate was conceived long before the world of internet marketing and advanced technology, so it may be much higher nowadays. Consider the fact that people like familiarity—we all have our favourite restaurants, stores, and such. Repeat customers are reliable, an opportunity for upselling, and can keep businesses running during slow economic times.

With that said, the best protocol is to make sure you’re giving new customer acquisition and customer retention equal attention.

Retention rate and churn rate go hand in hand. Churn rate is the inverse of the customer retention rate. If a business has a 90% retention rate, its churn rate is 10%. It’s important to track these numbers together to make sure the math is correct. Some businesses rely on the retention rate figure, while others focus on churn rate. Either way, these numbers help small business owners make informed and strategic decisions.

Measuring your customer retention rate helps you go beyond a customer acquisition focus and evaluate customer satisfaction. It allows you to make sure you aren’t losing customers as fast as—or faster than—you’re adding them. Running a business without repeat customers is like treading water or running in place.

A company’s growth depends on more than sales and marketing performance. Tracking customer retention informs the business of what adjustments are needed to meet sales goals and growth targets. It’s a good predictor of revenue for the upcoming quarter, not to mention an indicator of how well your customer service department is performing, It also reveals when it’s time to add or adjust your loyalty program.

Customer retention rate calculations can also create a competitive advantage, especially when you track them over time. Additionally, repeat customers tend to visit more often, provide referrals, and spend more than new customers, according to Bain & Company research.

Here’s how to measure customer retention and calculate your customer retention relate so you can reap these benefits.

Each time you calculate your retention rate, the first step is to determine a specific period of time such as a month, a year, or a quarter. Once you’ve decided on the time period, select the start date and end date that apply.

Next, you’ll need to gather the following information:

The number of retained customers at the start of the time period (S)

The number of retained customers at the end of the time period (E)

The number of new customers acquired during the time period (N)

Plug these numbers into the following formula:

CRR = ((E-N)/S) x 100

This formula isn’t at complicated as it may appear. Once you gather all the necessary information, simply subtract the number of new customers from the number of customers retained at the end of the time period. Then take the resulting number and divide it by the number of retained customers you had at the start of the time period. To convert that figure to a percentage, multiply it by 100 and you’ll have your customer retention rate.

Let’s look at an example:

If you start with 2,000 customers (S), end with 2,200 (E), and added 400 new customers (N) during the period your formula looks like this:

((2,200 – 400)/2,000) x 100 = 90%

This reveals that you kept 90% of your customers and lost 10% through churn.

Since replacing lost customers costs more than retaining them, it’s important to dig deeper to understand if this turnover will mean trouble to your particular business. For example, if your new customers are spending more than the ones you lost, this may not have a major impact on your bottom line. However, if you’re retaining customers and they are spending less or downgrading subscriptions to less costly ones, this could mean trouble in the long run.

Benchmarking retention and churn rates depends on the size, revenue, and economic factors around your business. Most estimates say a churn rate between 2.5% and 5% is good, and less than 1.5% is great. Of course, these figures depend on your business model and industry. Speak with local experts in your network to determine a retention rate goal.

Another consideration is your cost of acquiring new customers. If your customer acquisition cost is extremely low, retention may be less of a concern than if it’s high. Remember to look at revenue to provide a more complete picture.

Calculating the retention rate involves a simple formula, but several nuances and variables can trip up business owners if they’re not careful. Here are some mistakes to avoid.

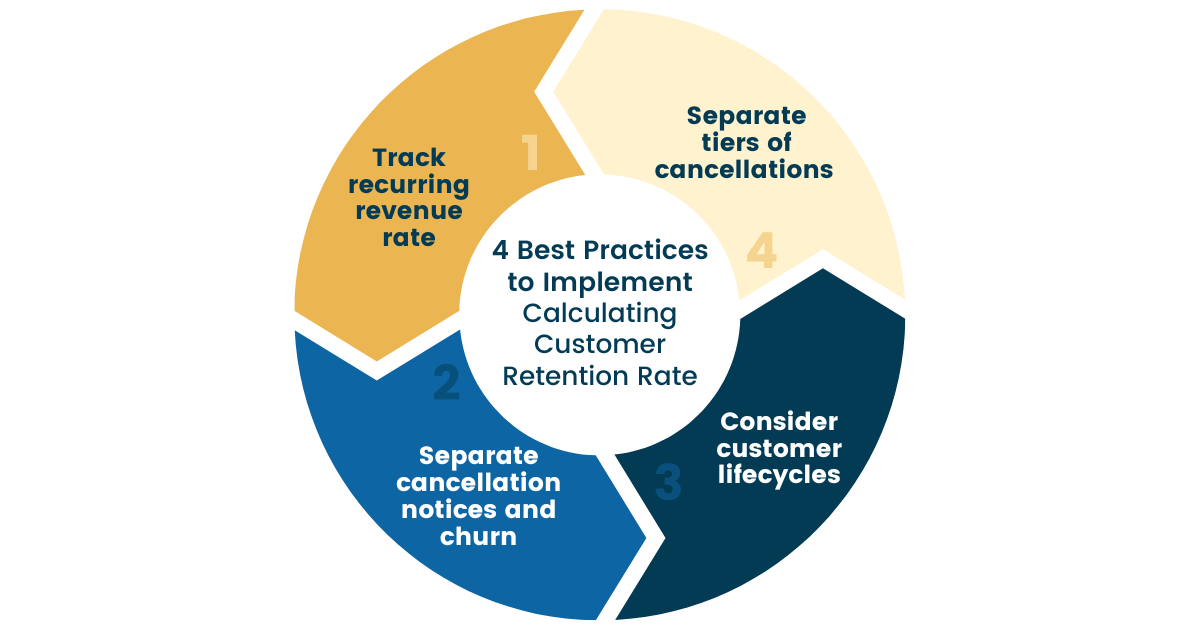

Depending on your business model, churning customers might carry different weights. Tracking the recurring revenue rate identifies the percentage of lost revenue, not just a customer count. This will help business owners identify warning signs, even if the customer retention rate remains high.

Another consideration when using a recurring revenue model is to separate cancellation requests and churn. Churn represents customers who are no longer paying any money, while cancellation requests come from customers who indicated they will be cancelling their subscriptions or membership. This is important because the timeframe between when customers indicate they want to cancel and their last billing date is a period of immense opportunity. You can enter these customers into win-back campaigns, which can lead to revenue-saving successes.

Another tactic to get more granular with customer retention rate is to factor in customer churn and how it impacts customer lifecycles, as in how long the customer was a paying subscriber. For instance, if most customers are cancelling within three months, business owners should look at their onboarding structure and make improvements. If customers are cancelling after a longer period—say, two years—business owners can implement annual or quarterly business reviews to ensure long-term customers are getting the attention they need and translating to greater customer lifetime value.

Separate tiers of cancellations (if relevant)

Lastly, you can break down customer retention rates by subscription tier. This shows which types of subscriptions are the most successful, as well as whether previous subscriptions that are now grandfathered to older customers are more or less effective.

Customer retention rate is not a standalone indicator of the overall health of your business, but you must track it routinely to ensure you can proactively address issues as they arise. Numbers and spreadsheets can’t run a business for you, and you can’t replace customer service and hard work. However, important metrics like the CRR can serve as a guide for decision-making. This eliminates some of the stress and guesswork that comes with owning and growing a business.

Consider this quote from leading author and consultant Chip Bell about customer retention: “Loyal customers, they don’t just come back, they don’t simply recommend you, they insist that their friends do business with you.”

Calculating your customer retention rate—and creating strategies to improve it and turning average customers into loyal customers—is the first step toward building a network of loyal, revenue-driving customers.

1 Customer survey conducted in 2017 among Act! customers.